THERE ARE SIGNIFICANT BENEFITS TO INCORPORATING ALTERNATIVE INVESTMENTS INTO A DIVERSIFIED PORTFOLIO. WE ELIMINATE THE BARRIERS THAT MAKE INVESTING COMPLICATED, INEFFICIENT AND CUMBERSOME

ACCESS ALTERNATIVES DIFFERENTLY

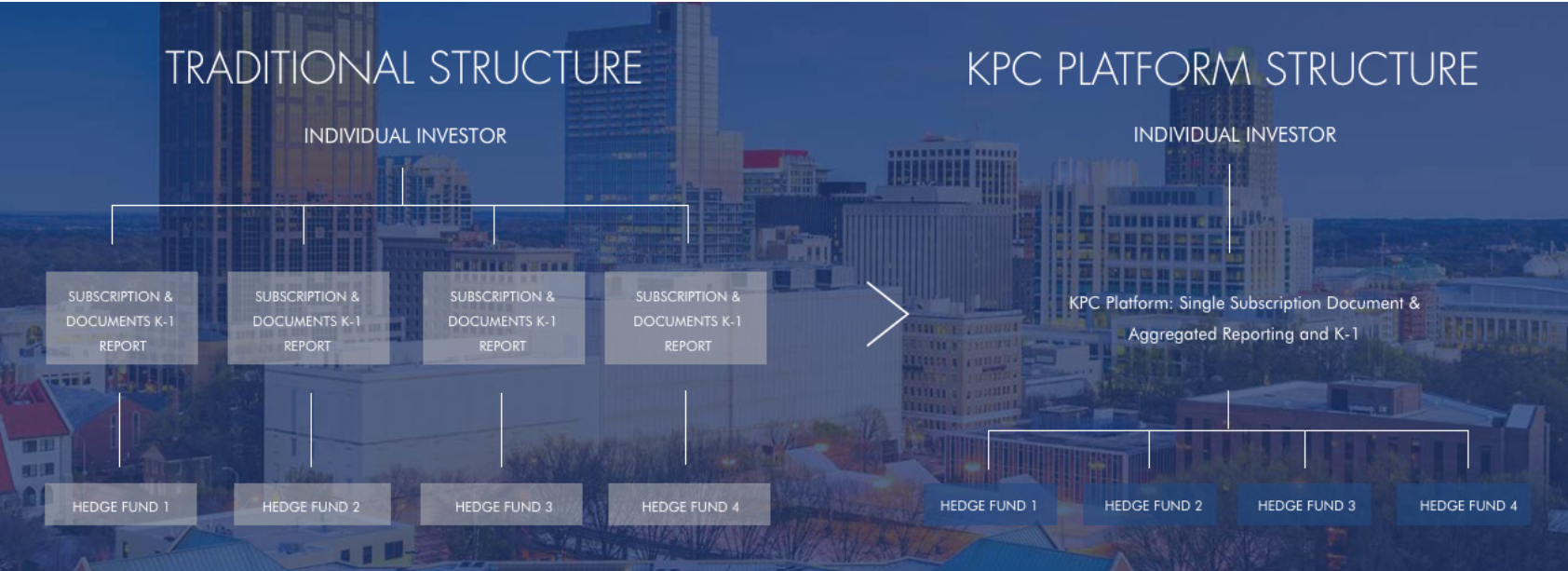

Kelly Park Capital provides independent wealth advisors with difficult to attain investment opportunities within the alternative investment space. These offerings are thoroughly vetted and evaluated by Kelly Park Capital’s team of investment professionals and presented and packaged for the advisor in an easy to explain and easy to access structure which also offers portfolio construction tools & investment management analytics supported by comprehensive reporting and simplified tax reporting

Our in-house hedge fund evaluation program, platform flexibility and deep understanding of alternative investments ensures our platform delivers best-in-class investment options customized to clients’ individual allocation needs

CUSTOM BUILT TOOLS, DESIGNED WITH ADVISORS IN MIND Kelly Park Capital empowers wealth advisors with the technology, investment solutions, and support to scale and manage their business. Our unique platform helps differentiate your offering and creates the opportunity to expand wallet share